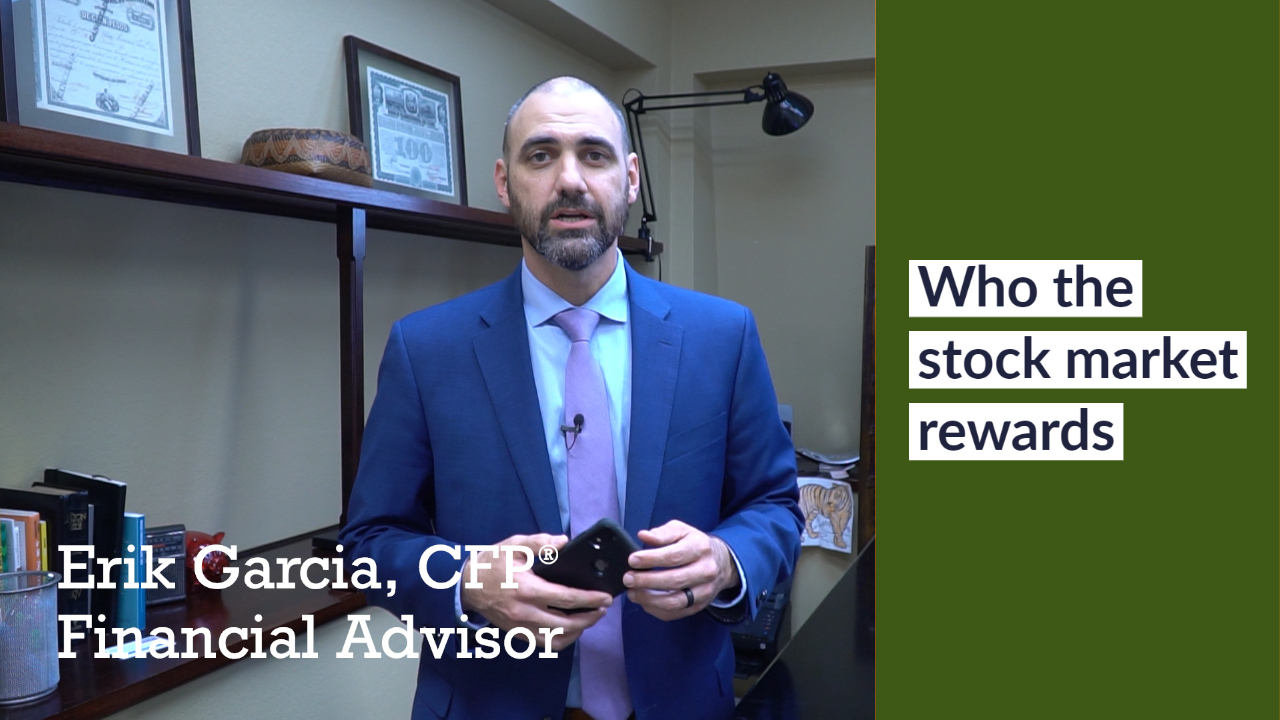

Erik Garcia

CFP®, ChFC®, BFA™

Co-Founder, Plan Wisely Wealth Advisors | Financial Planner | Podcast Host | Speaker

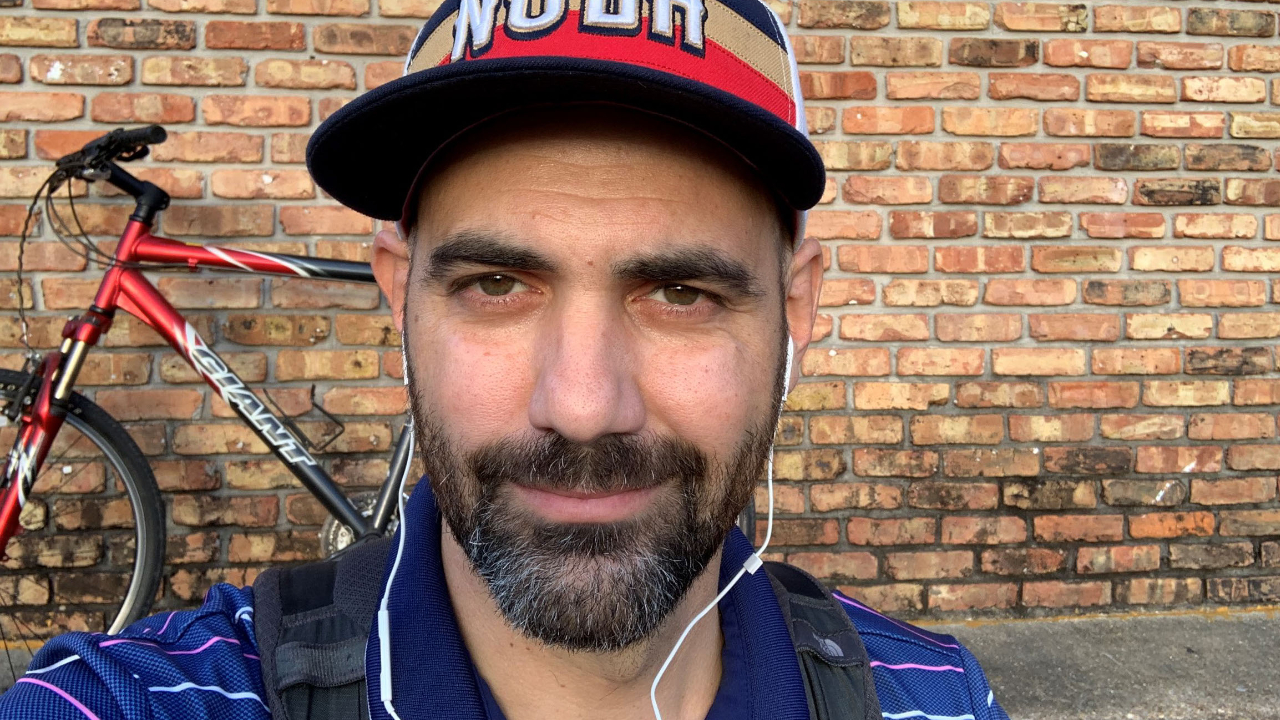

I didn’t grow up dreaming of becoming a financial planner. At one point, I wanted to be a deep snapper in the NFL. Later, I thought I’d follow in my dad’s footsteps selling insurance—and I did, for a while.

Everything changed during my time at Tulane University’s A. B. Freeman School of Business. One day, I watched a professor trade one of his personal investment accounts, and that moment sparked a lifelong fascination with investing and financial behavior.

That curiosity grew into a career helping people connect their money with their values. Along the way, I collaborated with a family therapist—a partnership that reshaped how I view financial planning. I realized money isn’t just about numbers; it’s about behavior, relationships, and what truly matters to each person.

Today, as a CERTIFIED FINANCIAL PLANNER™, Chartered Financial Consultant®, and Behavioral Financial Advisor™, I help clients make wise financial decisions in alignment with their purpose. My work spans investment management, tax and estate planning, retirement planning, and behavioral finance, but my true passion lies in helping people feel confident and intentional about their financial lives.

As co-founder of Plan Wisely Wealth Advisors, I believe financial planning should be human, not transactional. Our mission is simple: to equip and resource clients to make wise financial decisions they won’t regret.

I’m also the **co-host of the podcast **Stuff About Money They Didn’t Teach You in School, where we explore the intersection of money and behavior through practical, down-to-earth conversations. Previously, I co-hosted the Building Us podcast with Dr. Matt Morris, focused on relationships—with people, community, and money.

In addition to my advisory work, I’m also the co-owner of Garcia Insurance Services, following my dad’s legacy on the property and casualty side of the business. I serve on the executive committee of the Algiers Economic Development Foundation, on the Board of Restoration Counseling, and on the Next Gen Council for Osaic, representing the voice of emerging advisors in our profession. I’m a regular speaker on developing healthy money habits and have been featured on industry podcasts discussing financial planning, behavioral finance, and personal development.

My credentials include the CFP®, ChFC®, and BFA™ designations, as well as the Series 6, 7, 26, 63, and 65 licenses.

On A Personal Note:

I was born in New Orleans to Cuban parents and am proud to call one of America’s most soulful cities home. My wife, Jennifer, and I are the proud parents of three kids. I’m a lifelong Saints fan and Chelsea soccer fan, and a firm believer that an afternoon isn’t complete without un cafecito (a Cuban espresso).

I’m also passionate about gardening and often say that the garden is the best classroom—it teaches patience, growth, and the importance of tending to what matters most.

My earliest “money memory” came from my grandfather, who would empty his pocket change into an ashtray. He let me take the quarters, which I traded with my uncle for dollar bills, so I could buy baseball cards. That early lesson in value exchange shaped how I think about money even today.

My favorite book is Proverbs, filled with timeless wisdom about life, character, and stewardship. I believe that planning wisely leads to living confidently—and that confident living creates the space for true success.

You can contact me at Erik@Plan-Wisely.com

My Content

Podcast

Coping with Financial and Family Stress During Times of Anxiety – Plan Wisely Episode #7

By Erik Garcia

EPISODE SUMMARY These are trying times, both financially and psychologically. Dr. Matt Morris rejoins Erik Garcia and Jag today. Together, we cover the volatile market as well as the “new normal” of having families together…

Topics Building Us Podcast, Couples & Money

Article

The #1 Factor That Will Determine How Much Money You Will Have In The Future

By Erik Garcia

Topics Video

Podcast

Are you Self-Employed? It can be Taxing, with Roy Taylor, CPA – Plan Wisely Episode #6

By Erik Garcia

EPISODE SUMMARY More and more entrepreneurs are working for themselves and focusing on the “Gig Economy.” However, this can have far-reaching tax implications. Today, Erik Garcia and Jag sit down with Roy Taylor, a partner…

Topics Taxes

Podcast

Should I w2 or 1099 My Sales Team

By Erik Garcia

In this bonus episode, Erik has a conversation with Roy Taylor CPA on his thoughts on 1099ing vs w2ing your staff. The context is Insurance Producers, but if you employ people, it is a…

Topics Taxes

Article

Thinking About Rolling Over Your 401k?

By Erik Garcia

An increasing number of employers offer 401(k) plans for their employees. It’s estimated that the average employee will have 10 jobs before they hit 40 years old. This means that there are millions of 401(k)…

Topics Retirement Planning